Regal Owner Cineworld Told To Fast Track Theater Closings And New Business Plan By Bankruptcy Judge

Last year, Cineworld was forced to enter into Chapter 11 bankruptcy, with crippling debt and slower-than-anticipated recovery in the aftermath of the pandemic putting the theater chain in a bad place. The company is one of the largest movie theater operators in the world, with U.S. moviegoers familiar with them via Regal Cinemas. As the proceedings have rolled on, a bankruptcy judge has ordered them to speed things up and get its affairs in order. That includes figuring out which theaters to close.

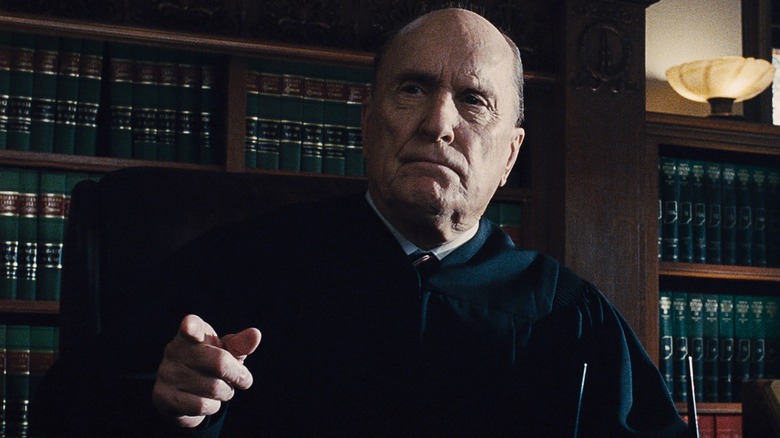

As reported by Deadline, Judge Marvin Isgur recently told Cineworld in court that they need to speed things up in terms of reorganizing the business. This includes negotiating new terms with landlords, handling situations with debtors and, rather crucially, what theaters to close. Isgur, a U.S. bankruptcy court judge in the Southern District of Texas, had this to say:

"We are not going to stick around forever. The debtors need to be aggressive. I am not sitting here for a year, or for six months, to figure out what shops are closing. That is a process that is going to happen now. I have been very patient in this case [but] I want to see more action in terms of what this future company is going to look like...We need to move on with life."

While the box office has rebounded over the last year or so, the pandemic did much damage. AMC and other chains have recovered, in some way, but Cineworld/Regal struggled under the weight of its debt. Given that the bankruptcy case has already been going on for around four months, the judge's impatience is not difficult to understand. But moving on with life, in this case, means that theaters could be closing up shop in North America and abroad in the near future.

No half measures

As it stands, Cineworld has closed 23 of its theaters and has reached new agreements with around 25% of its landlords. But given that they operate thousands of screens, that is a relatively small percentage. Of note, last year, the company was granted access to special financing that can be used to help them restructure the business. The problem? They were already around $9 billion in debt at the time. So yes, the situation is dire and Isgur is probably right to want to see results, given the state of the company.

Cineworld's bankruptcy attorney Josh Sussberg said that "The management team has made it clear time and time again it is willing to close additional theaters absent landlord engagement [so] we encourage everyone to come together." The company is also running a sale process, which could lead to parts of the business being divested to interested parties. Rumors recently began circulating that AMC had talks about acquiring some of the chain's theaters, though nothing came to pass. Isgur, speaking further, emphasized that the leadership needs to focus on making a business plan for the future, while acknowledging the challenges the industry is facing.

"[Make sure the restructuring plan] gets this right...gets the debt levels right, the footprint of locations right. To put the company on a path to success. We don't want to take half measures here. It looks like this industry, more than most, is in a state of major flux and [that] would have occurred at some point with or without Covid. And people need to figure out what is the future of the industry. Guesswork by very smart people who are good at guessing. And we are not going to be in a world of certainty in this case."

Uncertainty be damned, Cineworld has some tough choices to make, and they have to start making them fast.